The Center for Regional Analysis routinely updates data that provide a greater understanding of what drives the Greater Washington regional economy.

View the current set of indicator data charts here

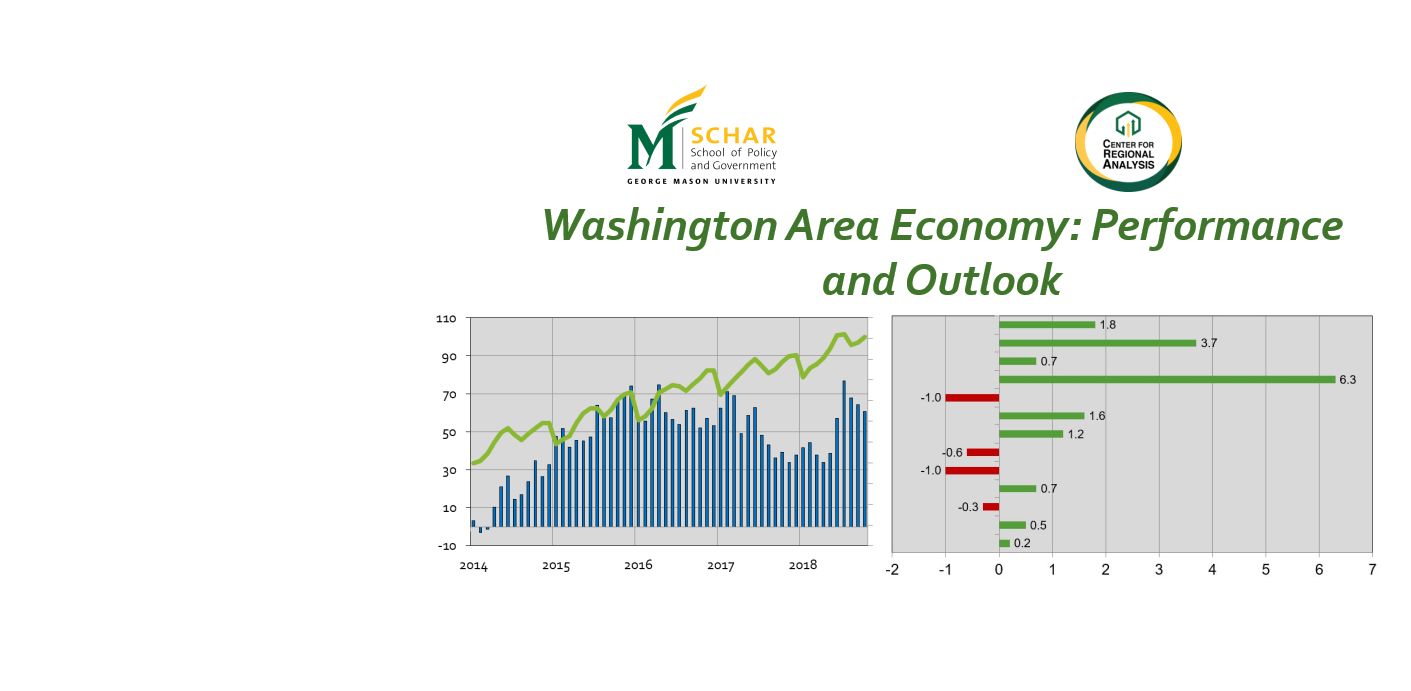

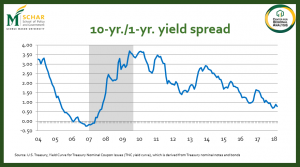

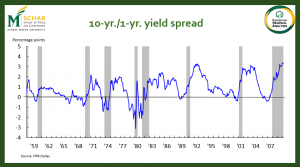

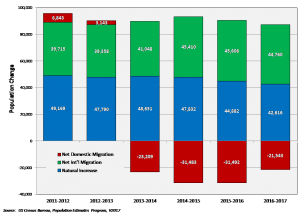

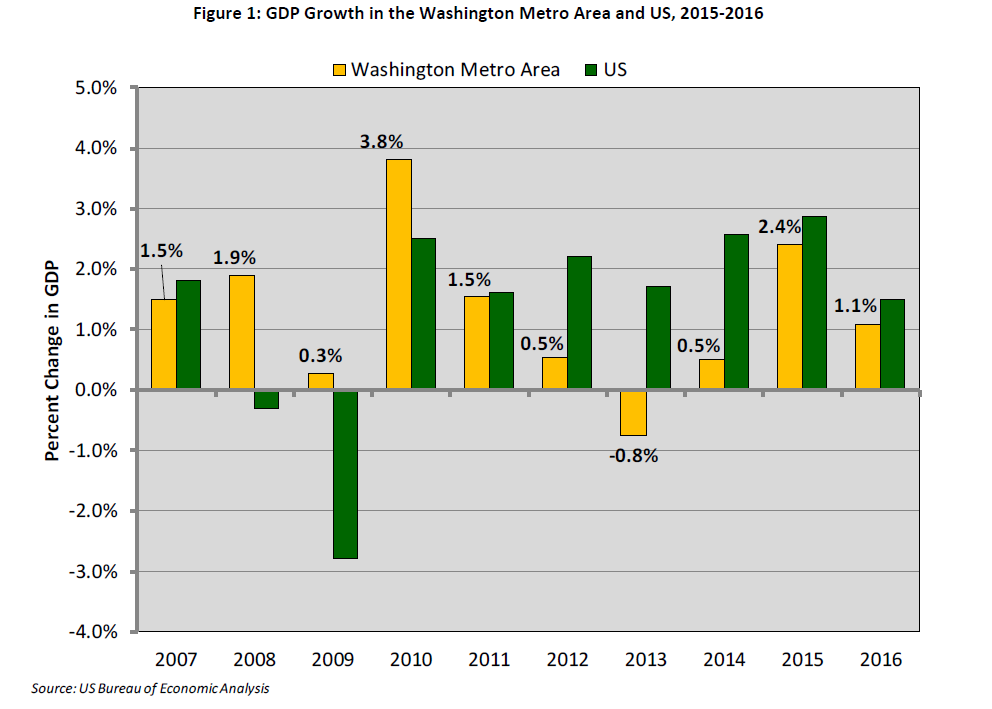

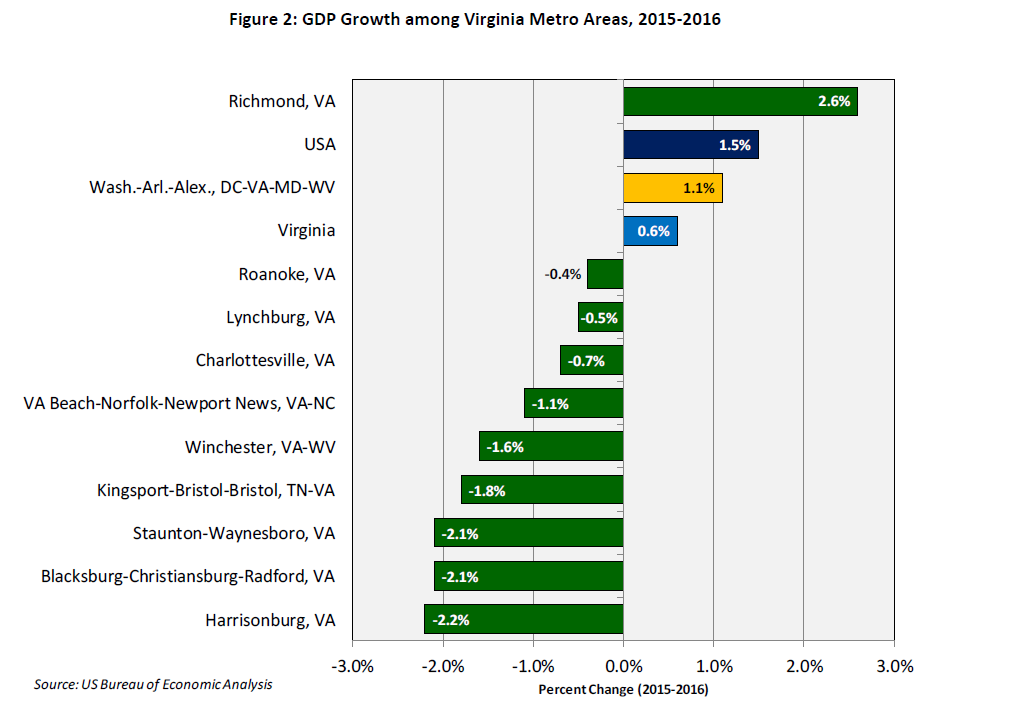

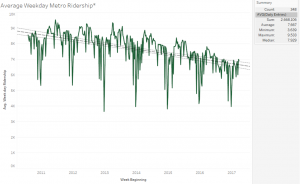

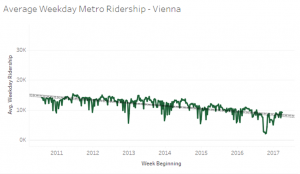

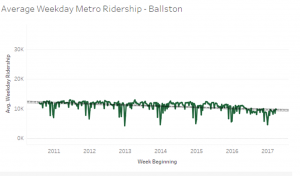

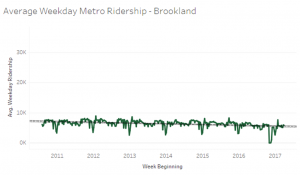

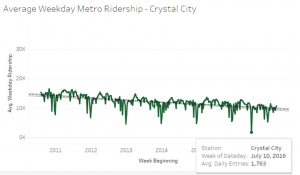

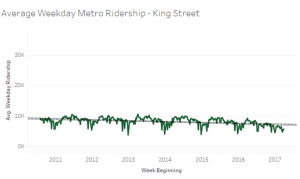

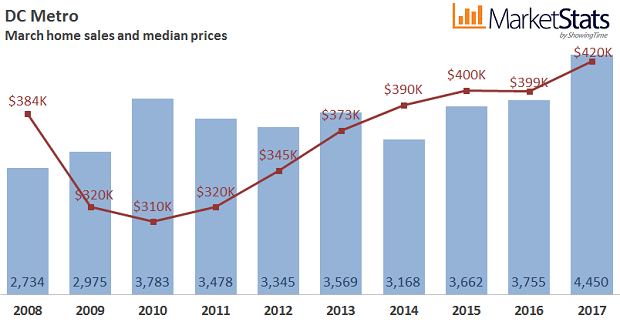

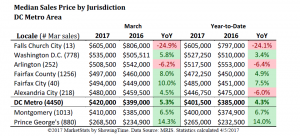

CRA produces more than 60 charts and graphs summarizing trends in the national and regional economies and housing markets. Data elements include gross domestic product, jobs, unemployment, consumer confidence, coincident and leading indices, interest rates, sales of existing and new homes, home prices, and regional economic forecasts, among many other categories. CRA develops information concerning both the overall regional economy and focused/select economic and housing data for Northern Virginia, Suburban Maryland, and the District. This set of charts is updated when new data are released.