The Center for Regional Analysis is proud to support the efforts of the GO Virginia Initiative. CRA has been assisting the Region 7 GO VA Council in the creation of their Growth and Diversification Plan – a strategic plan which will establish criteria that guide the selection of projects developed by the regions will effectively move the economy forward. The completed document is available here.

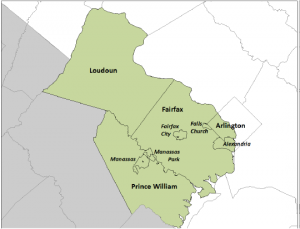

Region 7 includes the counties of Arlington, Fairfax, Loudoun, and Prince William and the cities of Alexandria, Fairfax, Falls Church, Manassas, and Manassas Park in Northern Virginia.

Other GO Virginia Support

In addition, CRA partnered with Old Dominion University and the Natelson Dale Group in the creation of the Growth and Diversification Plan for Region 5 (Hampton Roads). That report is available here.

In early Summer 2017, CRA was contracted by the Virginia Department of Housing and Community Development (DHCD) to compile baseline data for each of the seven GO Virginia Regions. The resulting data is available here in presentation and excel formats.

About GO Virginia

The Virginia Initiative for Growth and Opportunity in Each Region (GO Virginia) was initiated by Virginia’s senior business leaders to foster private-sector growth and job creation through state incentives for regional collaboration by business, education, and government. Recognizing the harsh effect of deep federal budget cuts on a Virginia economy that is overly dependent on public-sector jobs, they launched the GO Virginia campaign to work for regional cooperation on private-sector growth, job creation, and career readiness. For more information visit: http://www.govirginia.org/ or http://www.dhcd.virginia.gov/index.php/go-virginia.html